Forsy’s

Flagship Project

US$622.6M

NPV pre-tax

91m/lb

Uranium Production

US$1,751M

Operating Cash Flow

Property Description and Location

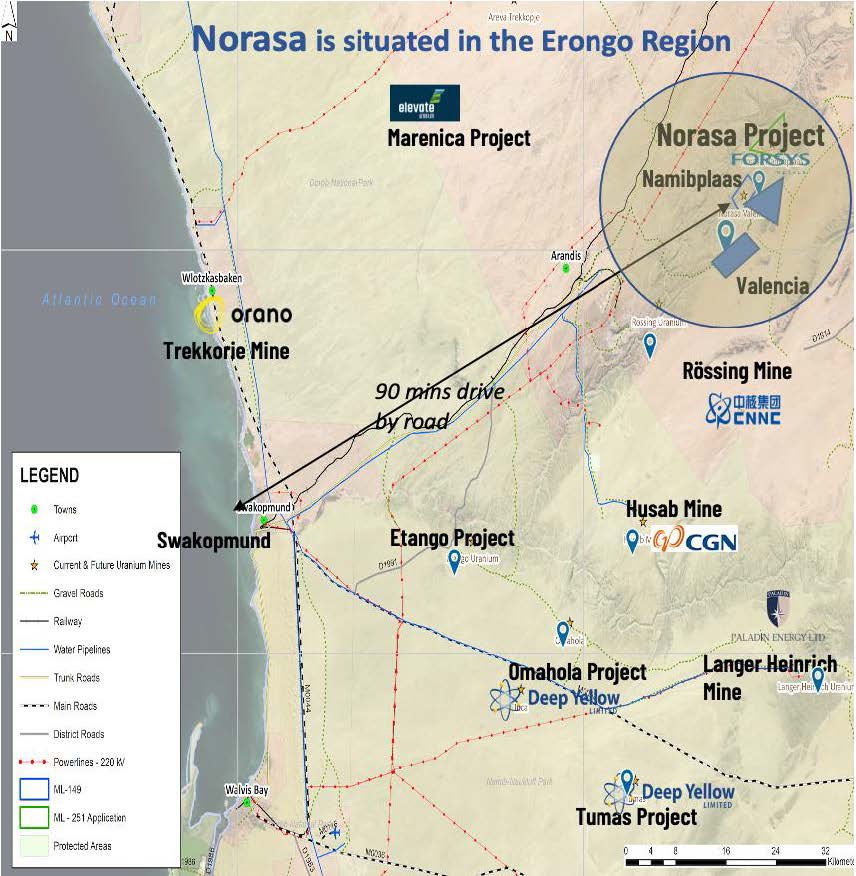

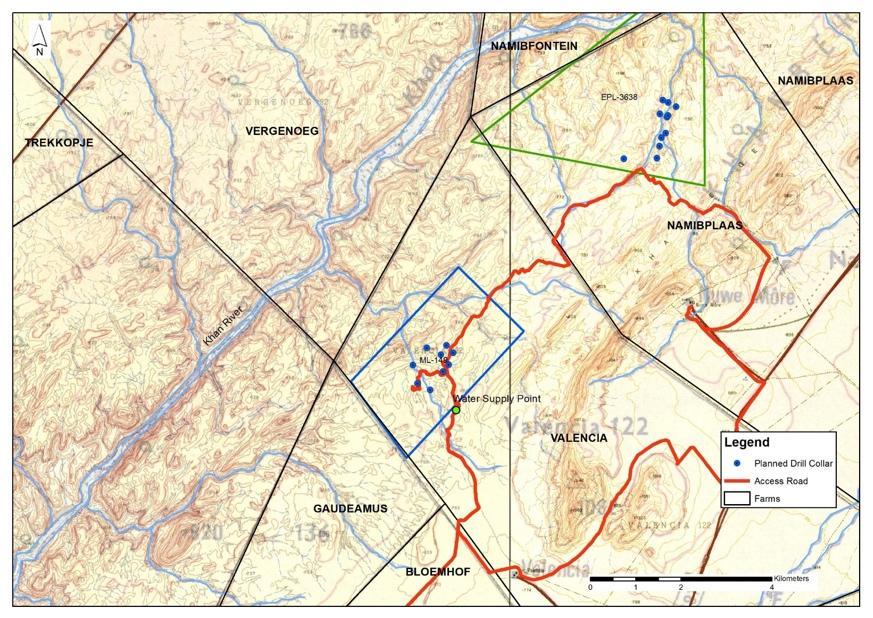

The Company’s flagship project is Norasa that includes the wholly owned Valencia project, which has a 25-year mining licence (ML-149) and a 100 % interest in the Namibplaas project under Exclusive Prospecting Licence (EPL-3638), and which is located 5 km northeast of Valencia. Both mineral licences are registered in the name of Valencia Uranium (Pty) Ltd (“Valencia Uranium”). Both deposits have NI 43-101 compliant mineral resources. The properties are located in the Erongo Region of the Republic of Namibia, approximately 75 km south-west of the town of Usakos and also about 75 km north-east of the town of Swakopmund in central-west Namibia. Valencia and Namibplaas together are known as the Norasa Uranium Project. Access to Norasa is via the B-2 main tar road linking the coastal towns of Walvis Bay and Swakopmund with the capital city of Windhoek in the interior. From the B2 highway, a 27 km constructed gravel road across the Khan River valley constitutes the main access to the project.

Mineral Tenure, Permitting, Rights and Agreements

The Company currently holds a 25-year Mining Licence (ML-149) over its Valencia main and satellite deposits, valid until 2033. The licence is renewable. Furthermore, Exclusive Prospecting Licence (EPL-3638) over the Namibplaas deposit, which was granted on 07 November 2006 and has been renewed since that date. The EPL covers 1,266.38 ha and is currently valid to 01 February 2026. The Company is in the process to make application to the Ministry for converting EPL 3638 to a full 25-year Mining Licence (“ML”). EPL 3638 remains in good standing with the Ministry.

The entire Valencia mineral tenure area is located on privately owned farmland. As required by law, an agreement must be entered into between a mineral licence holder and the landowner to allow exploration activities. In order to progress a project to mine development, a compensation agreement is required to offset the effects of the operation. In April 2009, Valencia Uranium entered into a compensation agreement with the owner of the farm Valencia 122, in relation to Section 52 of the Minerals Act of 1992, granting Valencia Uranium unrestricted use of the land on and around ML-149 covering an area of 3,327 hectares. A similar agreement was reached with the owners of the neighbouring farm “Bloemhof 109”, for an area of 594 ha located to the south of ML-149, for the construction of infrastructure and as the primary access to the Valencia site. Forsys is in the process of purchasing Portion-1 of farm Namibplaas 6,714 ha, which comprises 94% of the EPL-3638 mineral licence area and the entire prospecting ground of interest at Namibplaas.

These land agreements and acquisition of farm Namibplaas facilitate planning for the necessary infrastructure components required to support future mining operations. The infrastructure has been approved by the MME for accessory works development to the envisaged operations and includes inter alia waste dumps, tailings storage facility, pipelines, power lines, roads, process plant, explosive magazines, etc. Environmental clearance was obtained for all operations relating to Valencia (ML-149), although some amendments to the Valencia plan will be required to include the Valencia East satellite pit and relocation of some of the processing infrastructure. All amendment issues will be covered in an amendment Environmental Impact Assessment (EIA) and Environmental Management Plan (EMP).

Namibplaas is located approximately 5km northeast of the Valencia deposit on the farm “Portion-1 of farm Namibplaas 93”

Forsys is actively engaged with MME but needs to conduct additional infill and exploration drilling on Namibplaas and satellite orebodies before it can secure a full Mining Licence at Namibplaas.

Forsys holds an Environmental Clearance Certificate (ECC- 2300417) from the Ministry of Environment, Forestry and Tourism for both ML-149 and EPL-3638. The ECC is valid for three-years, presently until 23 May 2026. It allows the Company to conduct mineral exploration and resource definition on its ML and on EPL-3638 and also to advance its development plans on the ML. The present ECC excludes mining at Namibplaas, also linear infrastructure development and operation. Therefore, the team has embarked on the process of conducting an Amendment EIA with various specialist work for the revised and larger Norasa project development.

Environmental Impact Assessment (EIA) work was previously done towards this project but excluded the Namibplaas resource. A detailed EIA and EMP was compiled by Digby Wells & Associates (DWA) in 2007-08, with subsequent environmental audits and some additional revisions to maintain the validity of the Environmental Clearance Certificate to the present date. There are no historical environmental liabilities for either the Valencia or Namibplaas properties.

Geology and 2024 Mineral Resource Estimate (MRE)

The uranium mineralization at Valencia is hosted by granitic alaskite intrusions and a narrow halo within the immediate country rock contacts. The alaskites comprise massive stock-like bodies, dykes and sills of varying thickness and veins and veinlets, which are either conform with or transgressive to the Damara Sequence metasedimentary host rocks.

Uranium mineralization at Valencia has been identified over an area of 1,100 m north-south by 500 m east-west. The mineralisation dips steeply to the south and has been identified by drilling to a depth of 499 m below surface (VA26-152). The Namibplaas deposit has been drilled over an extend of approximately 1,500 by 500 m and has been intersected to approximately 250 m depth below surface.

Uranium mineralisation is present as uraninite, typically (U,Th)O2, and secondary uranium minerals, coffinite, U(SiO₄)1−x(OH)₄ₓ uranophane, Ca(UO2)2SiO2.7H2O and uranothallite (Ca2U(CO3)4.10H2O). Trace betafite, (Ca,U)₂(Ti,Nb,Ta)₂O₆, and brannerite, (Th,U,Ca)Ti2(O,OH)6, have been observed at Valencia and documented. Uranium phosphate minerals are not observed at Valencia or Namibplaas.

A team of mineral resource professionals computed the mineral resource data and compiled updated Mineral Resource Estimates for the Valencia and Namibplaas Uranium deposits. The statement includes a comprehensive review and update to all of the parameters for a Mineral Resource Estimate (“MRE”) using recent drill results together with the 2005-2011 data that informed the October 2013 Norasa MRE and the 2011 Maiden Resource for the Namibplaas deposit. A National Instrument 43-101 (NI 43-101) Technical Report was issued on 13 May 2024 and describes the Mineral Resource Estimation for Forsys Metals’ Norasa Uranium Project.

For updating the MRE the drillhole database was analysed, checked for errors and outliers. Individual mineralized domains were defined, and capping was applied where applicable. Using Datamine® software semi-variograms were calculated on the transformed composite data for eU3O8.

Block models were generated for each orebody at 30 m by 30 m blocks in the X (easting) and Y (northing) directions and 5 m blocks in the Z (elevation) direction. The block models were not rotated. Sub-celling was applied to optimally fill the modelled wireframes, resulting in a minimum sub-cell of 7.5 m x 7.5 m x 2.5 m in X, Y and Z, respectively.

The Mineral Resources are reported within US$ 120/lb U3O8 pit shells, with a cut-off grade of 40 ppm U3O8 for each of the deposits at Valencia Main and East, (“Valencia”), under Mining Licence (ML-149) and US$120/lb U3O8 at 40 ppm U3O8 cutoff at Namibplaas (“Namibplaas”) under EPL-3638. The MRE is summarized as follows:

For the overall Norasa project, a conceptual pit constrained MRE for total deposits assessed from previous (2005-2011) and 2023 drilling results is estimated to be:

- Valencia Main Measured and Indicated Resource at 40 ppm U3O8 cutoff is estimated to be 152 Mt at 136 ppm eU3O8 (equivalent U3O8). Measured and Indicated contained metal is estimated at 45 Mlbs U3O8, at 40 ppm U3O8 cutoff;

- Valencia Main and East Inferred Resources are estimated at 5.7 Mt at 120 ppm eU3O8 with 1.3 Mlbs U3O8 contained metal oxide, at 40 ppm U3O8 cutoff; and

- Namibplaas Inferred Resources are estimated to be 218.7 Mt at 85 ppm eU3O8 with 41.1 Mlbs U3O8 contained metal oxide, at 40 ppm U3O8 cutoff.

Drilling Programs

Drilling under the new management has been ongoing on ML149 since April 2023. The drilling programs aim to expand and upgrade the Valencia resources, adjacent to the main pit, and also to explore areas of satellite mineralization that were delineated from exploration work that included aerial photo interpretation; geological mapping; aeromagnetic surveys; airborne radiometric and ground scintillometer surveys; and review of historic drilling data. Investigation of the satellite areas by drilling aims to assess mineralization extension potential at targets in the vicinity of the Valencia Main pit and to test the potential of further targets to the north and east of the current MRE pit. Drilling at Namibplaas stopped in June 2023 due to a dispute with the landowner but is planned to resume in April 2025.

The drilling program focuses on:

- Satellite alaskite intrusions and potential extension of the known resources, i.e. Valencia Main, Valencia East and Namibplaas

- Infill drilling at the known deposits to upgrade the resource confidence

- Sampling for new metallurgical test work and for optimized process design;

- Further geotechnical drilling, logging and sampling, along with downhole surveys (trajectory, gamma, Optical Televiewer) at Valencia and Namibplaas;

- Geotechnical logging and geo-mechanical sampling to refine pit designs;

- Geochemical analysis and geo-metallurgic test work.

- Sampling and testing local groundwater resources and establishing additional groundwater monitoring boreholes;

For updates on the drilling program and revised mineral resource estimates please refer to our regular News Releases.

Resource Estimation Data – Sampling, Geochemical Analysis & Quality Control

Mineral resource estimation uses a combined data set of diamond drilling, reverse circulation drilling, sample assays and Gamma probe equivalent assays.

Appropriate quality assurance and quality control (QAQC) monitoring is a critical aspect of the sampling and assaying process in any exploration program. Monitoring the quality of laboratory analyses is fundamental to ensuring the highest degree of confidence in the analytical data and providing the necessary confidence to make informed decisions when interpreting all the available information. Quality control (QC) comprises procedures designed to maintain a desired level of quality in the assay database. Appropriate documentation of QC measures and regular scrutiny of quality control data is conducted to safeguard the validity of the dataset used for the mineral resource estimation process.

All exploration drill samples are assayed by XRF and/or ICP method and downhole gamma probing. Quality control samples are used for check-assay in an alternative independent lab with ICP method. Conversion of resources from Indicated to Measured is bolstered by infill drilling that is assayed and by gamma probe eU3O8.

The Valencia QAQC programme reserves three in every twenty samples as QC samples (resulting in approximately 16% QAQC samples), usually one duplicate, one Certified Reference Material (CRM) and one certified blank sample.

All aspects of the sample handling, logging, bagging, labelling and sample submission are considered reasonable and acceptable by the Qualified Person (QP) for use in a Mineral Resource estimate.

Optimisation Work Plan

Pit Design Modelling

The updated resource block model is used to perform open pit economic models. Pit slope design parameters are being reviewed to include lithological logging and geo-mechanical test work from additional drilling. Preliminary pit designs are subjected to geotechnical confirmation testwork and 3-D fault modelling. The current pit designs are being used to optimize the mining fleet Capex and Opex for the different production scenarios and owner vs. contractor mining operation.

The project assumes a conventional open pit, drill, blast load and haul operations executed by a mining contractor. Mining Opex estimates are derived from mining schedules being developed within the design sequence of the various pits and pushbacks and mining cost proposals received from leading mining contractors. The primary alternative scenarios being considered are mill throughput at 7.5 Mtpa and 15 Mtpa respectively and Tank Leach vs. Heap Leach processing options.

The cut-off grade for each scenario also varies according to processing costs parameters and overall process recovery.

Column Leaching Process Optimization Work

Column Leach tests are underway, and the work involves a systematic process to enhance the efficiency and effectiveness of extracting the uranium mineralisation from the ore using sulphuric acid solutions.

This comprehensive column leach program is designed to test a wider range of head grades, followed by composite samples selected according to the anticipated mining plan with respect to head grade and lithologies. In particular, the lower head grades to be tested with the concomitant reduction in resource grades. This program is designed to test a range of leaching variables, including crushing by High Pressure Grinding Rolls (HPGR) to take advantage of the so-called particle cracking to expose increased mineral surface area for improved leaching. Column work to date has shown higher uranium grades in coarser fractions of the residue.

With lower cut-off grades, the head grades to be tested in this program range from 80ppm to 200ppm U3O8 in order to determine ore extraction potential. Variables to be tested include:

- Crushing methods (conventional vs HPGR) ahead of leach and crush size to be tested and traded off.

- Curing time ahead of column

- Proportion of acid added to curing and agglomeration

- Acid dosage strength

- Acid irrigation rates

- Effect of binder.

- Mineralogical studies of feed and residues.

- Grading and size by analysis of feed and residues.

These envisaged tests involve evaluating the impact of HPGR generated particle size distribution on subsequent leaching processes and optimizing parameters to achieve desired leach outcomes.

Please refer to our regular News Releases for updates on the test work program.

Process Design

DRA Global are appointed as the study contractor to deliver high level engineering design and to provide preliminary cost estimates for the process.

The methodology includes mass balance and process block flow diagrams to produce a preliminary sized mechanical equipment list (MEL). Pricing for major equipment items is sourced from the market. Factors deemed appropriate for the type of equipment are applied to compile the overall capital estimate. Layouts are prepared to determine conveyor lengths and earthworks quantities, amongst other, to refine cost estimates.

The MEL provides the basis for the power requirements and mass balance the basis for water requirements. Infrastructure supply costs were estimated based on the utility requirements and in turn provide utility tariffs for operating cost estimates.

Market pricing for reagents and consumables are sourced from the market for operating cost estimates. Labour costs are benchmarked from other operating mines in the region.

Process Engineering Optimisation

The process engineering design is being optimized in parallel with a focus on:

- Increasing confidence in equipment costing from the market by expanding specific vendor equipment pricing.

- Value engineering of the flowsheet and optimizing layout and materials handling circuitry.

- Optimise heap leach cycle times to reduce residence time and reduce pad sizes.

- Optimise layout to reduce costly earthworks.

- Evaluate upfront ore sorting to increase head grade to the process, discard waste and increase Run of Mine and metal quantities for processing.

- Critique acid supply, investigate bulk supply from the East and cost of delivery to site which is a major contributor to processing cost.

- Value engineer major operating cost contributors including hydrogen peroxide, power (optimize crushing and materials handling circuitry) and water (more detailed mass and water balancing).

We endeavour to provide regular News Releases for updates on the test work program.

Bulk Sampling

Various bulk samples are required for the following workstreams:

- Sorting test work to upgrade the Run of Mine ore prior to leaching

- HPGR crushing test work to provide prepared sample for bulk testing

- Large scale column testwork to inform process design

- Pilot heap leach facility for confirming process design

Large diameter diamond drilling serves for various samples required for geometallurgic testwork including the aspects listed above.

After site assessment and selection, the company established a plan for developing a box cut with the objective of retrieving approximately 20,000 tonnes of typical run-of-mine as a fresh and representative sample material from the orebody. The initial blast for the box cut was taken in August 2024.

Infrastructure

Infrastructure in Namibia has been ranked No 1 in Africa (Fraser Institute report 4).

Water Supply

Norasa has received NamWater’s (Namibia’s national bulk water utility) assurance for supply of water during the potential construction phase of the project.

Various options for ground water are being evaluated in close proximity to the project to supply water during construction phase. In addition, Water supply for the mine and mineral processing operations will be sourced from one or a combination of the three potential sources listed below:

- Water sourced from the Namwater pipeline (at B2 highway): The source of this water is the Orano desalination plant located, approximately 30 km north of Swakopmund. The closest bulk water supply point is the Rössing mine reservoirs, located 24 km to the WSW of ML-149. Installation of a 31 km long pipeline through the Khan River to the site would be required. Upgrading of the existing pipeline and pumping system would also be necessary.

- Ground Water: A sizeable paleochannel aquifer is present, five to ten kilometres southeast of the Valencia site. Detail investigation on this aquifer as part of the geohydrological assessment is scheduled to evaluate this aquifer’s groundwater supply potential.

- Khan River: The company already establied 5 large diametre boreholes for water abstraction tests into the Khan River Alluvium Aquifer. Hydrological and geohydrological specialist work as part of the amendment EIA will determine the viability of this option.

Power Supply

The nearest power off-take point that can supply Norasa is the Khan substation, located at Ebony, 26km north of the project site. However, the direct route is very rugged through the Khan Valley and tributaries and an alternate indirect transmission route of nearly 30km has been laid out by NamPower, which is Namibia’s power utility service provider. The Khan substation has sufficient supply capacity and the preferred route for a powerline to the mine crosses the Khan River, using tributary valleys. The company is busy establishing alternative power supply options.

Roads

An industrial grade road has been established in 2011, linking the mine to the B2 highway, 12km northeast of Rössing. The total length of this new road is approximately 26km. Furthermore, a number of internal service roads have established.

Buildings

Forsys plans to establish a semi-permanent village for the mine development phase will be established 8 km from the process plant.